Flatiron Heights

Chattanooga, TN

This is a unique opportunity to invest in a historic property located near the center of the city. As a 506(b) investment, it offers accredited investors a 20% annual return.

History and Thesis

The Flatiron building was constructed in 1911 on the former multi-building site owned by S. R. Read at the intersection of Georgia Avenue and Walnut Street. Flatiron was named and designed after the famous New York City structure. Flatiron was originally designed by local Chattanooga architect, C. E. Bearden. Original plans included a mixed-use design whereby the first floor and basement were office use and the upper three floors housed 27 apartments. In 1986, the Flatiron building went through a major renovation upgrade and was turned it into a single-use office complex. In 1992, TE Holdings purchased the building and has owned it for the last 29 years. The Flatiron building was placed on the National Register of Historic Places by the National Park Service of the United States Department of Interior on July 23, 2020.

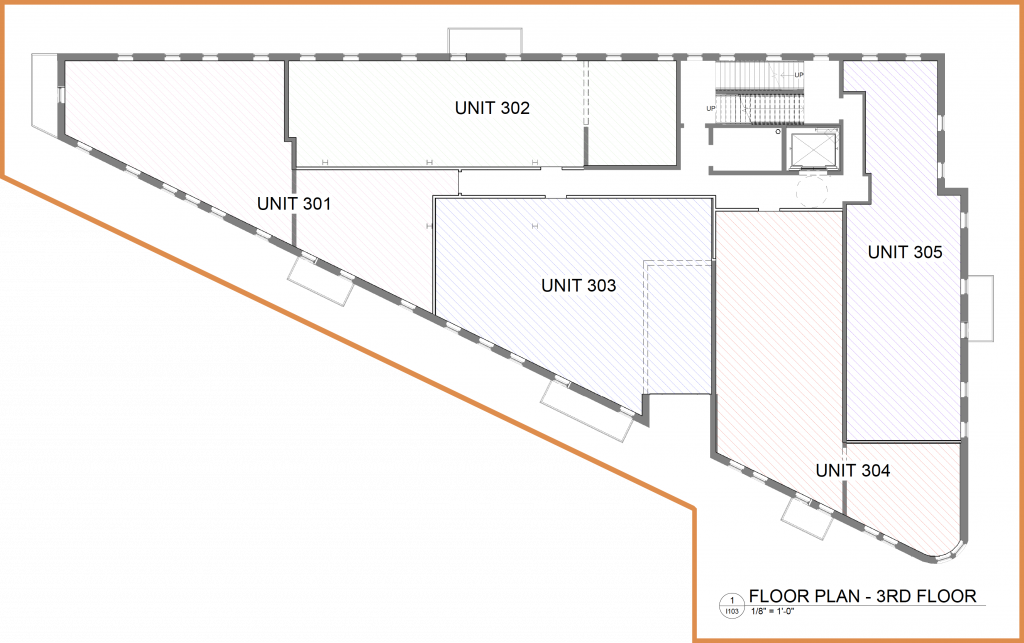

Fisher Bay and its financial partners currently have executed a Purchase and Sales Agreement with TE holdings to purchase the Flatiron building. Fisher Bay plans to renovate and restore the building back to its historic roots of mixed-use by continuing to offer commercial use on the first and basement floors and creating 15 premier finish luxury condominiums on the upper three floors.

Project Overview

Property Location

Chattanooga, TN

The Flatiron building lies near the center of Chattanooga, TN. It has excellent views of the city, overlooking notable buildings such as the Dome Building, Hamilton County Court House, and the Memorial Auditorium.

Business Plan

Existing

- Property in good condition, with dated look

- Single-use commercial office space

- Significantly below market rate leases

- Currently only month-to-month leases

Planned Changes

- Change to a mixed-property

- Renovate the basement & 1st floor to higher-end lease level office space.

- Renovate floors 2, 3, & 4 into 15 high-end condominiums

- Renovate parking deck to accommodate both office and condo tenants.

Investment Details

Historic Opportunity Zone

- 2+ year hold

- 20% annual return

- 8% preferred return for investors

Credit Union Debt

- 5 year fixed TVFCU Financing

- Construction to perm loan

- 75% LTV 1 year interest only

- 25-year amortization

Accredited Investors

- 506b investment open to accredited investors only

- 15 – 30% capital committed

Opportunity Summary

This 506(b) investment

Experienced Team

Robert Fisher

Fisher Bay, Sponsor

Dan LeVan

Fisher Bay, Sponsor

Bo Ferger

Fisher Bay, Sponsor